how does hawaii tax capital gains

Taxes in Hawaii Hawaii Tax Rates Collections and Burdens. 2022 State Capital Gains Rates Income Tax Rates and 1031 Exchange Investment Opportunities for the state of Hawaii.

Middle Class 2030 Graphing Middle Class Class

You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year.

. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. The difference between how much is withheld and how much is owed is the amount of your refund. A majority of US.

Hawaii has a graduated individual income tax with rates ranging from 140 percent to 1100 percent. Tax Law and Guidance Hawaii Taxpayers Bill of Rights PDF 2 pages 287 KB October 2019 Tax Brochures Tax Law and Rules Tax Information Releases TIRs. Income tax rate schedules vary from 14 to 825 based on taxable income and filing status.

Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. Hawaii tax forms are sourced from the Hawaii income tax forms page and are updated on a yearly basis. The 2022 state personal income tax brackets are updated from the Hawaii and Tax Foundation data.

Long term capital gains are taxed at a maximum of 725. Taxpayers with federal adjusted gross income over certain thresholds. The rates listed below are for 2022 which are taxes youll file in 2023.

Itemized deductions generally follow federal law. Hawaii has a 400 percent state sales tax rate a 050 percent max local sales tax rate and an average. The Hawaii capital gains tax on real estate is 725.

Hawaii taxes capital gains at a lower rate than ordinary income. States That Tax Capital Gains. Hawaii also has a 440 to 640 percent corporate income tax rate.

Under current law a 44 tax rate is. House members take their oaths of office on. The highest-income taxpayers pay 408 percent on income from work but only 238 percent on capital gains and stock dividends.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. Form N-15 for the year is available then the owner should file the.

If the collected amount is too large how do you obtain a refund. General coverage of federal laws that are relevant to Hawaii income tax or Hawaii estate tax Unreported Tax Court Decisions Tax Audit Guidelines. Taxes capital gains as income.

The Hawaii capital gains tax on real estate is 725. What is the actual Hawaii capital gains tax. The state of Hawaii will keep your money if you do not submit the appropriate refund requests.

DTAX Message 0201doc Author. States have an additional capital gains tax rate between 29 and 133. Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii.

The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96. Some States Have Tax Preferences for Capital Gains. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household.

The table below summarizes uppermost capital gains tax rates for Hawaii and neighboring states in 2015. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. Hawaii taxes gain realized on the sale of real estate at 725.

The federal government taxes income generated by wealth such as capital gains at lower rates than wages and salaries from work. The Hawaii capital gains tax on real estate is 725. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing.

A capital improvements made while owning the property. Offshore Tax Does Portugal tax capital gains or income from cryptoIf you are considered a tax resident in Portugal you will need to define if and how to. This applies to all four factors of gain refer below for a discussion of the four factors.

Short-term capital gains are taxed at the full income tax rates listed. Gain is determined largely by appreciation how much more valuable a property is when sold compared to the price paid when it was purchased. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

Digest of Tax Measures. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

Individual Income Tax Chapter 235 On net incomes of individual taxpayers. Learn about Hawaii tax rates for income property sales tax and more to estimate what you owe for the 2021 tax year. In Hawaii real estate generates 7 percent capital gains tax.

The highest rate reaches 725. Other factors in determining gain are. If the appropriate Hawaii income tax return ex.

How does Hawaiis tax code compare.

Monday Map State Local Property Tax Collections Per Capita Tax Foundation

Real Estate Or Bonds Which Is A Better Investment Investing Corporate Bonds Bond Funds

Hawaii Tax Rates Rankings Hawaii State Taxes Tax Foundation

Hours Worked Advanced Economy Graphing Employment

State By State Guide To Taxes On Retirees Kiplinger

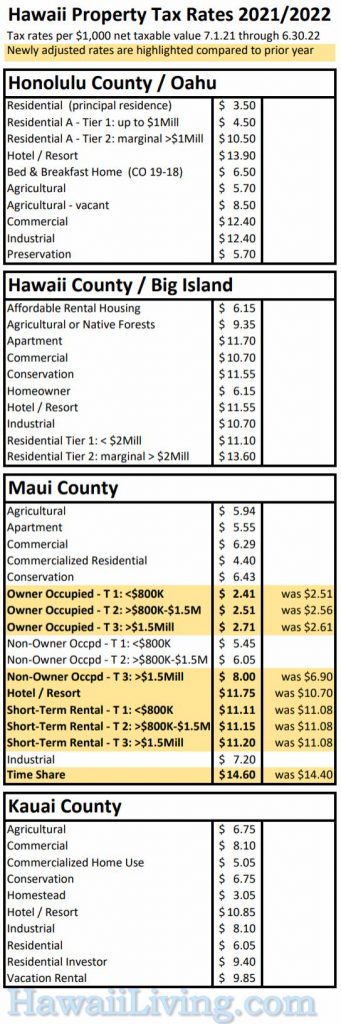

New Hawaii Property Tax Rates 2021 2022

Vacation Rental Specials Discount Travel Hi Fl Vegas Hilton Head Vacation Rental Florida Vacation Rentals Vacation

Segregated Portfolio Company Hermes Cayman Islands

We Buy Houses Fast We Buy Houses Sell House Fast Hawaii Real Estate

Hawaii State 2022 Taxes Forbes Advisor

Pin On Charts Graphs Comics Data

Pin By Kimberlee Erickson Daugherty On Financial Freedom Investing Understanding Things To Think About

The Hawaiian Shirt Through The Decades

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic